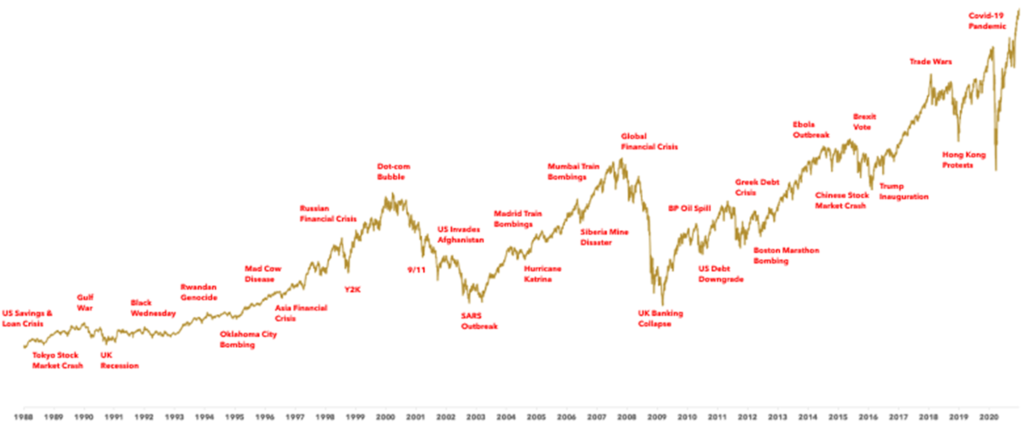

A Timeline of Negative World Events and Subsequent Market Responses

‘The stock market is a device to transfer money from the impatient to the patient.’ Warren Buffett

From the period beginning February 1988 to the end of 2022, global markets returned 1,598.30% with dividends reinvested, whereas inflation increased consumer spending by only 162.81% over the same period. £1,000 invested at the beginning of this period would be worth £16,983 by the end, achieving an annualised rate of return of 8.43%.

From a shorter-term perspective, since the start of 2015 to the end of 2022 global markets returned 127.77% with dividends reinvested, whereas inflation increased consumer spending by only 27.07% over the same period. £1,000 invested at the beginning of this period would be worth £2,278 by the end, achieving an annualised rate of return of 10.84%.

Source: FE Fundinfo. Returns are based on the MSCI World and CPI indices from 1 February 1988 and includes reinvested dividends where applicable.

Whilst during the moment volatility may seem like it will never end, if you review the long-term historical data, you’ll see that markets have rebounded and gone on to provide returns to investors. It’s important to hold your nerve during times of uncertainty as it is often following periods of distress that investors reap their greatest rewards.

The chart below shows the growth in global equity markets despite a relentless stream of negative world events.

Source: Bloomberg, Humans Under Management. Returns are based on the MSCI World price index from 1988 and do not include dividends. For illustrative purposes only.

Past performance is not necessarily an indication of future returns; the value of investments and any income from them is not guaranteed and can fall as well as rise. Overseas investments are affected by currency movements and exchange rates. If you would like investment advice on your individual circumstances, please do not hesitate to get in touch, telephone 01392 875500, info@SeabrookClark.co.uk.